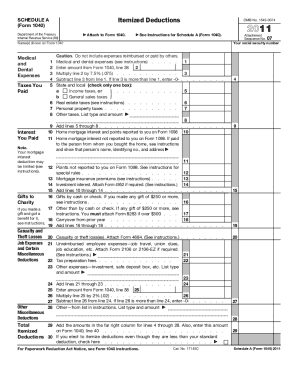

Schedule A Itemized Deductions 2024 Worksheet – With tax season underway, you’ll need to know the standard deduction amount you can claim for 2023. The standard deduction amounts tend to increase slightly each year to adjust for inflation. Let’s . WealthUp Tip: Federal tax returns for the 2023 tax year are due April 15, 2024 (April take the standard deduction, you can’t claim any itemized deduction found on Schedule A. .

Schedule A Itemized Deductions 2024 Worksheet

Source : real-estate-agent-tax-deductions.pdffiller.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govNurse Tax Deduction Worksheet Fill Online, Printable, Fillable

Source : nurse-tax-deduction-worksheet.pdffiller.comFree Paycheck and Salary Calculator: Calculate Take Home Pay

Source : factorialhr.comDeductions worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1 2023 2024 SPECIAL CIRCUMSTANCES WORKSHEET

Source : www.benedictine.eduW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comEmployee’s Withholding Certificate

Source : www.irs.govNurse Tax Deduction Worksheet Form Fill Out and Sign Printable

Source : www.signnow.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comSchedule A Itemized Deductions 2024 Worksheet Real Estate Agent Tax Deductions Worksheet Pdf Fill Online : To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are . For a taxpayer whose itemized deductions are less than indicate that you want to itemize your deductions using Schedule A. You will want to verify the amount of property taxes paid to be .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)